THE MINDSET OF A SUCCESSFUL TRADER!

For those of us who have been following this thread for quite a while, you should have by now been in a position where you take trades with confidence. That notwithstanding, I will today discuss the following specific steps on how to think and act to develop the mindset of a successful forex trader for ease of reference:

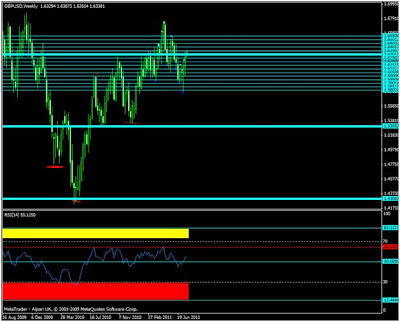

Step 1: Trade the Masterchart. It should be your No. 1 guide. The levels on the Masterchats I posted here are products of extensive research. What is happening in the forex market is that series of bad/good news (fundamental), manipulation/greed by the big players and most times fear/panic will always push the price from one support/resistance level to another. The truth of the matter is that the world economy generally is in shambles that is you will constantly see series of bad economic news followed by some good news resulting in “bull+bear+bull+bear” usually repeated over and over again.

Step 2: Trade in the direction of the weekly chart: The most reliable direction in the forex is the direction of the weekly. If the weekly is in a bear/bull mode it could stay that way for 4-10 weeks. Read the post on understanding trend to better understand this.

Step 3: The best trading opportunities are in the weekly: To increase your chance of success, sell only the top of nN, mM and buy around the base of V, U and W on the weekly charts. To identify these level signs, open a weekly chart, look closely and you will begin to recognize them. This simple trick will make your trade live a lot easier. I will begin to post this signs here

Step 4: Use money management: Use my recommended money management lots/account size ratio as follows:

0.01 lot for $1000 Trading account (max of 5 open trades at the same time)

0.10 lots for $10000 trading account (max of 5 open trades at the same time trades), etc

If you gather more experience or make money regularly, you can gradually increase your lot sizes or open trade to double the recommended lot sizes.

Go through the early part of this thread for a better understanding of my views of money management.

Step 5: Trade 1000+ Pips circle. Read and understand the 1000 pips price actions analysis. For the major pairs from the pin of a weekly candle expect 1000 and more before any major reversal. If the destination of 1000 pips PAA is closer to a major support/resistance on the master chart anticipate a touch of that level. Identifies expected levels in advance and you only monitor price reaction around such areas.

Step 6: Avoid think in terms of pips. Avoid thinking in terms of pips but in terms of actual currencies e.g. cent, pence, etc. If you think this you will avoid the graveyard of most forex traders (i.e. chasing low pips (5-100). If you think in terms of currency you will realize that a move 1000 pips move by GBPUSD move from 1.54000 to 1.64000 is a mere 10 cents. Further a 1000 pips move on GPBJPY from 130 to 120 is a merely 10 yen.

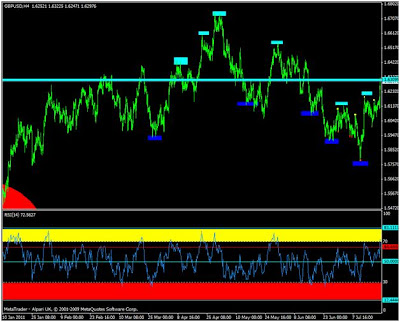

Step 7: Use H4 50 Pips Price Action Analysis. Utilise on price movement on H4 candles within 50 pips range to determine where to enter a trade. If you do this you will realize that you can have up 16 hours and more to enter a trade. Trading this way you do not need to sit in monitor your chart endlessly to get trading opportunity. In the worst case scenario you only need to check the chart every 4 hours.

Step 8: Enter trades using only M15 trade-friendly chart: When the price get to your desired areas on the higher time, enter your trades at the best discount by using M15 on a trade-friendly chart. If you need further explanation read most posting about creating a trade-friendly chart.

Step 9: Understanding the importance of 50 point level on RSI: 50 point level on RSI on your trade-friendly chart is usually an area where price normally stalls, changes direction or continues on any time frame.

Step 10: Set concrete zone on H4 chart: Price usually trade for most currency within 250-400 pips over a period of time within a concrete zone. The concrete zone is a good guide on where to place stop losses. Place stop losses slightly above the concrete zone for your sell and slightly below for your buy. Read my previous postings on concrete zone for better understanding of the concrete zones.

Step 11: Take profit at pre-determined level: Set your take profit at pre-determined points depending on your expected returns. If you are trading the weekly chart anything less than 200 pips is a waste of efforts. You should be aiming for 200 pips and above.

I attach the monthly and weekly charts for a better understanding of the above analysis